Crafting a unique brand

Organic

Primary

Secondary

a b c d e f g h i j k l m n o p q r

s t u v w x y z

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

a b c d e f g h i j k l m n o p q r

s t u v w x y z

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

I opted for this organic aesthetic to symbolise the fluidity and automation inherent in the app's operations. It also embodies a seamless structure that is not constrained by traditional conventions or limitations.

For the codification of different types of expenses and appeal to a young audience, a colourful palette completes the app’s identity.

Colour Guide

Typography

Poppins

Poppins

Competitive Analysis

Who are we designing for

Summary / Insights

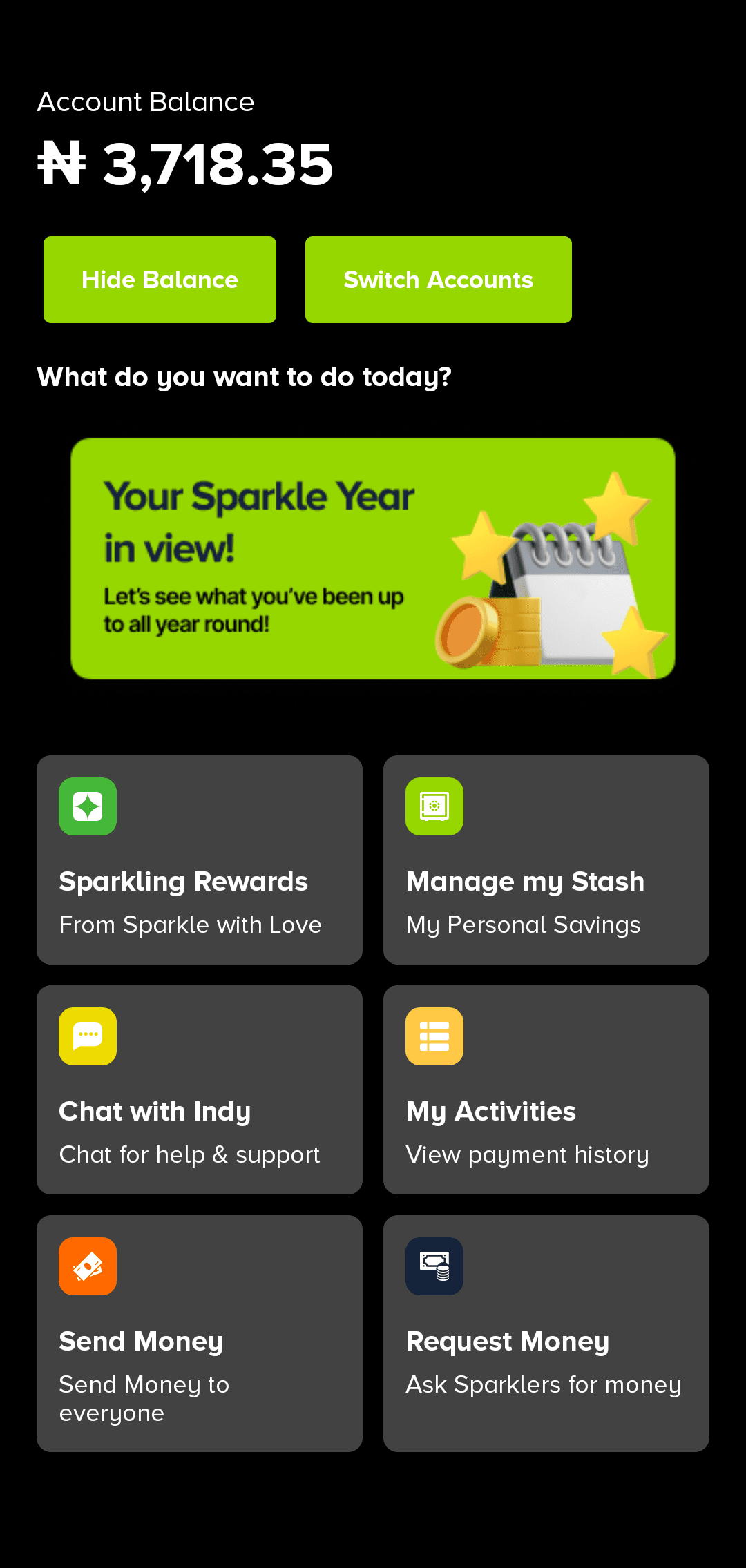

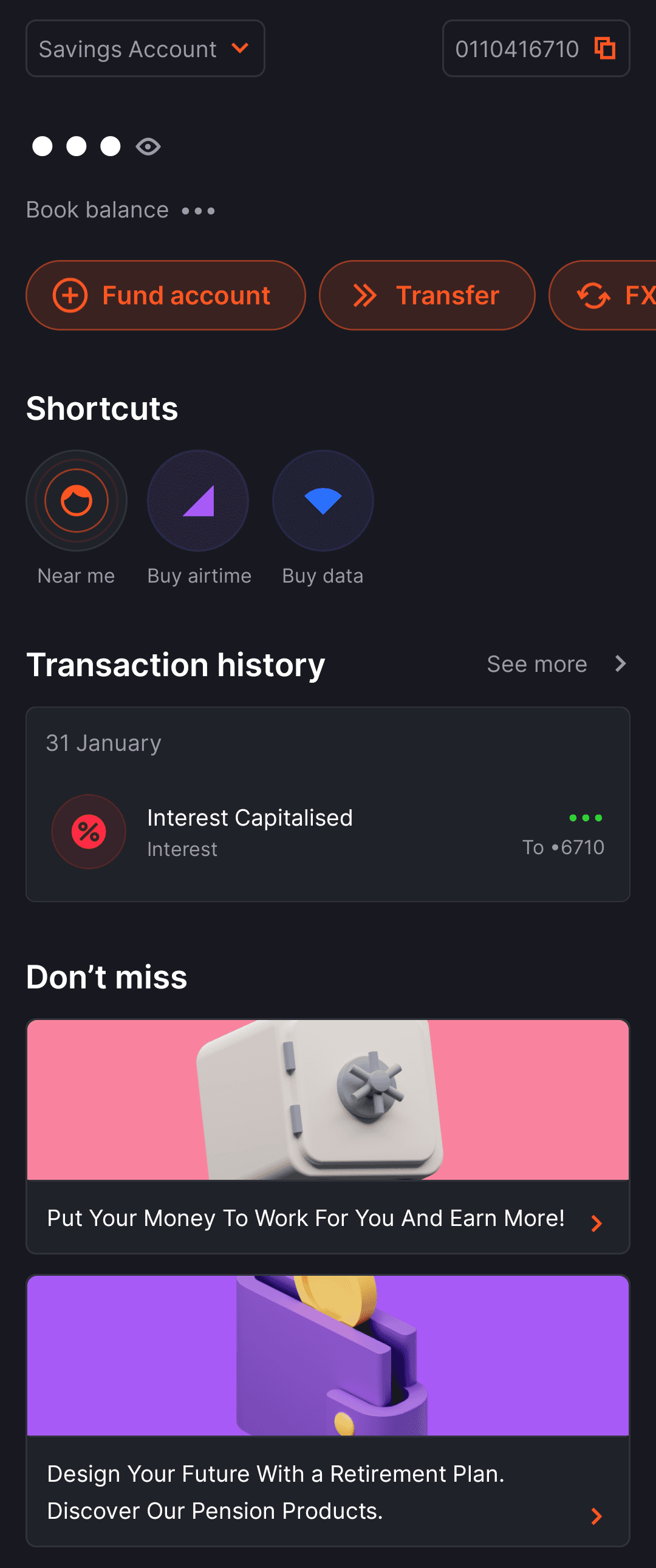

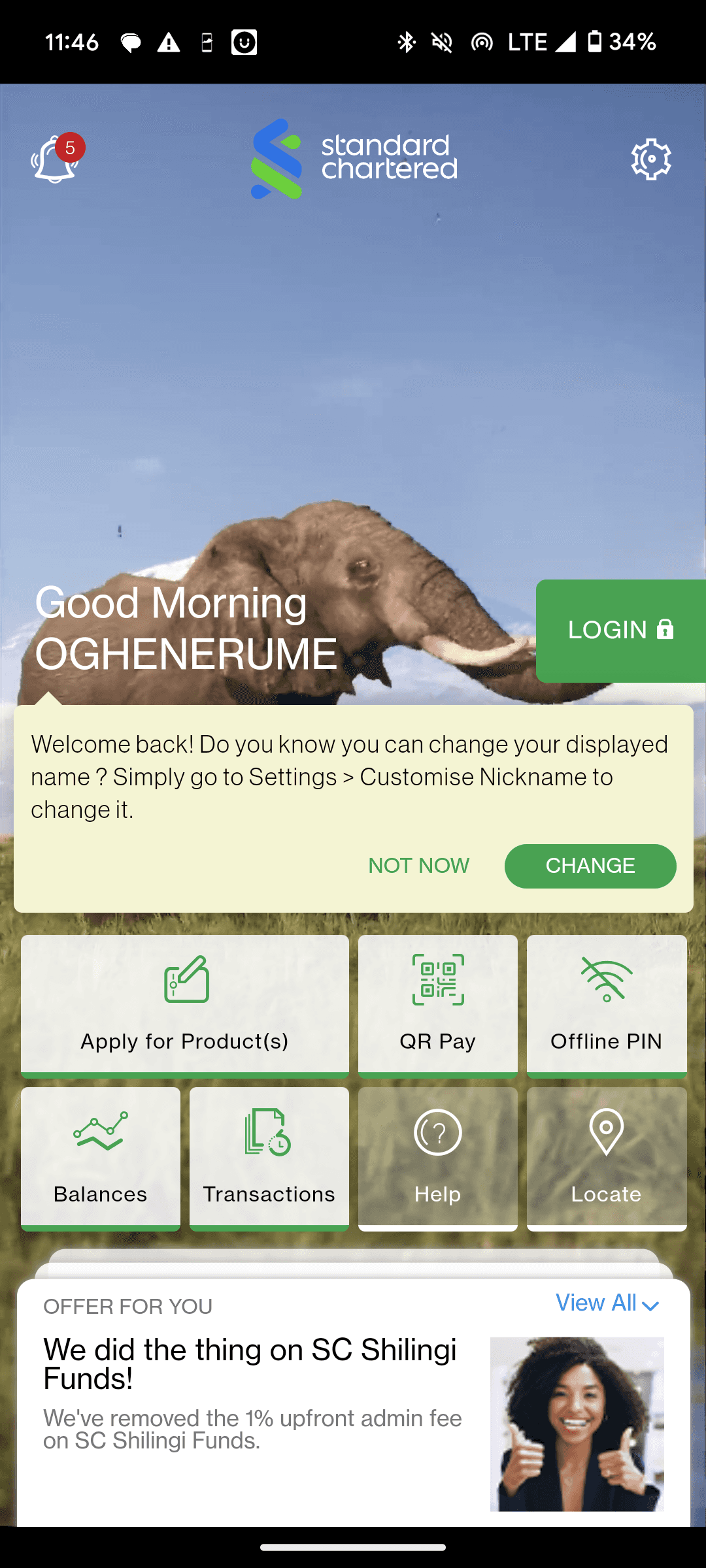

I analysed three mobile banking apps based on onboarding, login, interaction, accessibility, visual design, branding, and transaction happy path.

The banking apps In comparison were: GT Bank, Sparkle, and Standard Chartered.

Based on interviews and surveys, choose 3 most used mobile banking apps and analysed them, compared their features with these parameters: onboarding, Log in, interaction, accessibility, visual design, branding, happy path for a simple transaction.

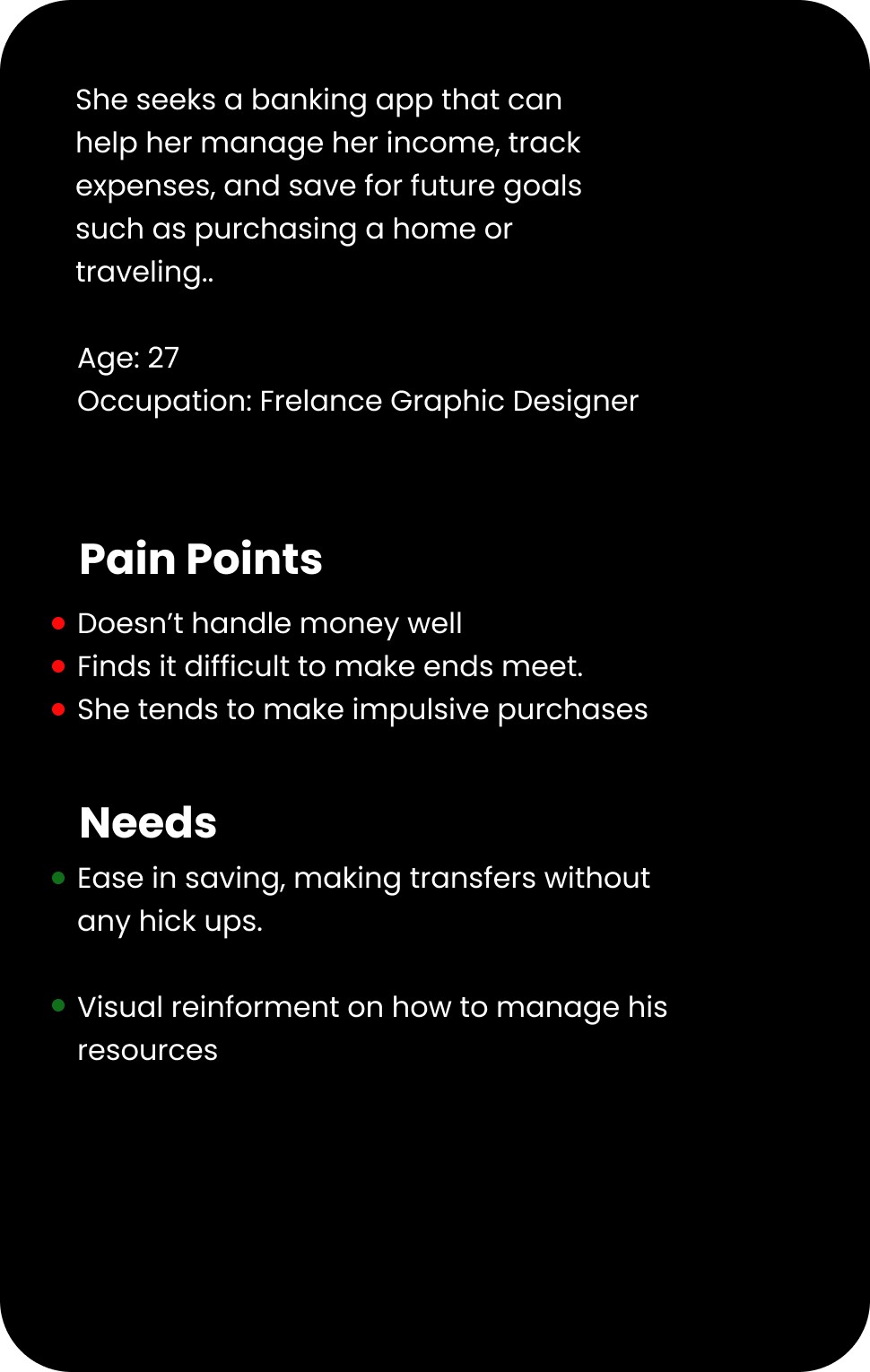

I created two persona archetypes based on research data to better understand our users. The archetypes encapsulate the target user group, their goals, behaviors, and the design objectives' context.

Poor

customer resolution

Delayed

transaction

Poor

Banking Incentives

Difficult user

interfaces

stressful banking

process

Some of the Pain Points users experienced.

of users confirmed that they use digital payment solutions every day.

of the users confirmed that customer service was one of the main considerations when choosing a bank app. .

90%

65%

of the users pointed out that the top 3 reasons they would use a banking app were for making payments, transfers, and savings.

80%

Research and Discovery

My research process was combination of online survey, in depth interviews, user reviews and usability testing to gain insight into various user experiences, frustrations and pain points.

After discovering a unique problem, I conducted further research to understand the challenges faced by users, in order to craft a one-of-a-kind experience.

The work was divided into numerous stages, and multiple iterations were performed st each stage to achieve the best result.

Sketching features

Testing

Iteration

prototype

Discover

Research

Ideate

Design

The Road Map

AI Powered saving and expense tool

Intelligent Chatbot

Subscription and

bills management.

Financial Education blog

Pay Bills

Money Transfer

Augmented reality (AR) features

Buy and Sell Foriegn exchange

Personalized expense plan

voice activated transactions

Sketching features

I devised specific features—ones not typically considered in a mobile banking app but that add value to the user experience

Solution

The Objective of the project

Develope a fully immersive personalized in-app journey that extends beyond typical marketing and advertising boundaries, showcased through imaginative visuals and groundbreaking functionalities.

Create a user-centric mobile banking application centered around personalised in app experience with innovative features and visually appealing design.

Problem.

Mobile banking apps often lack human-centered experiences from marketing to in-app interactions.

Weeks

12

Time Spent

Welcome to

Human-Centered

Banking

UI/UX Mobile Banking App

Tools

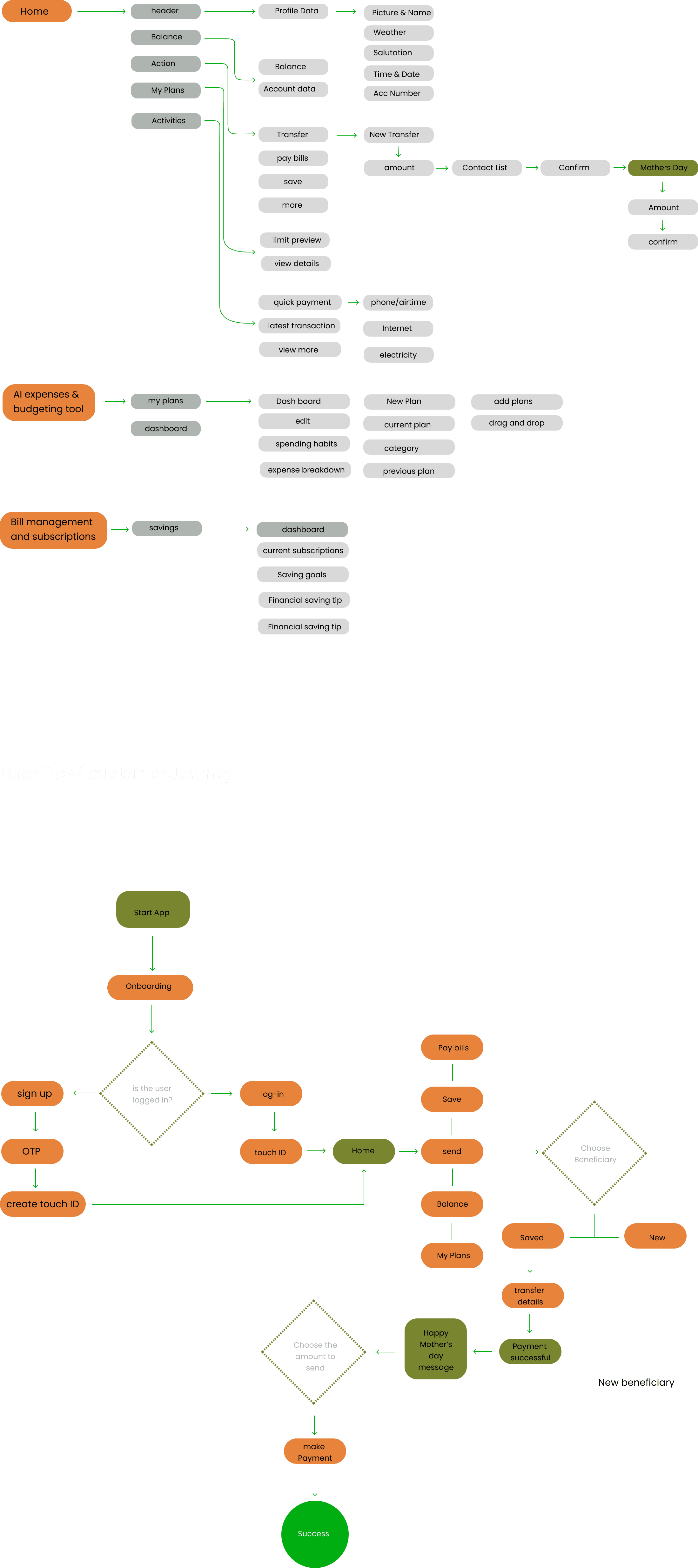

On Mother’s Day, I initiated a bank transfer and couldn't help but notice the absence of any in-app experience related to Mother's Day. While it's anticipated for brand marketing to be evident on such days across diverse touch points, the absence of an in-app experience caught my attention.

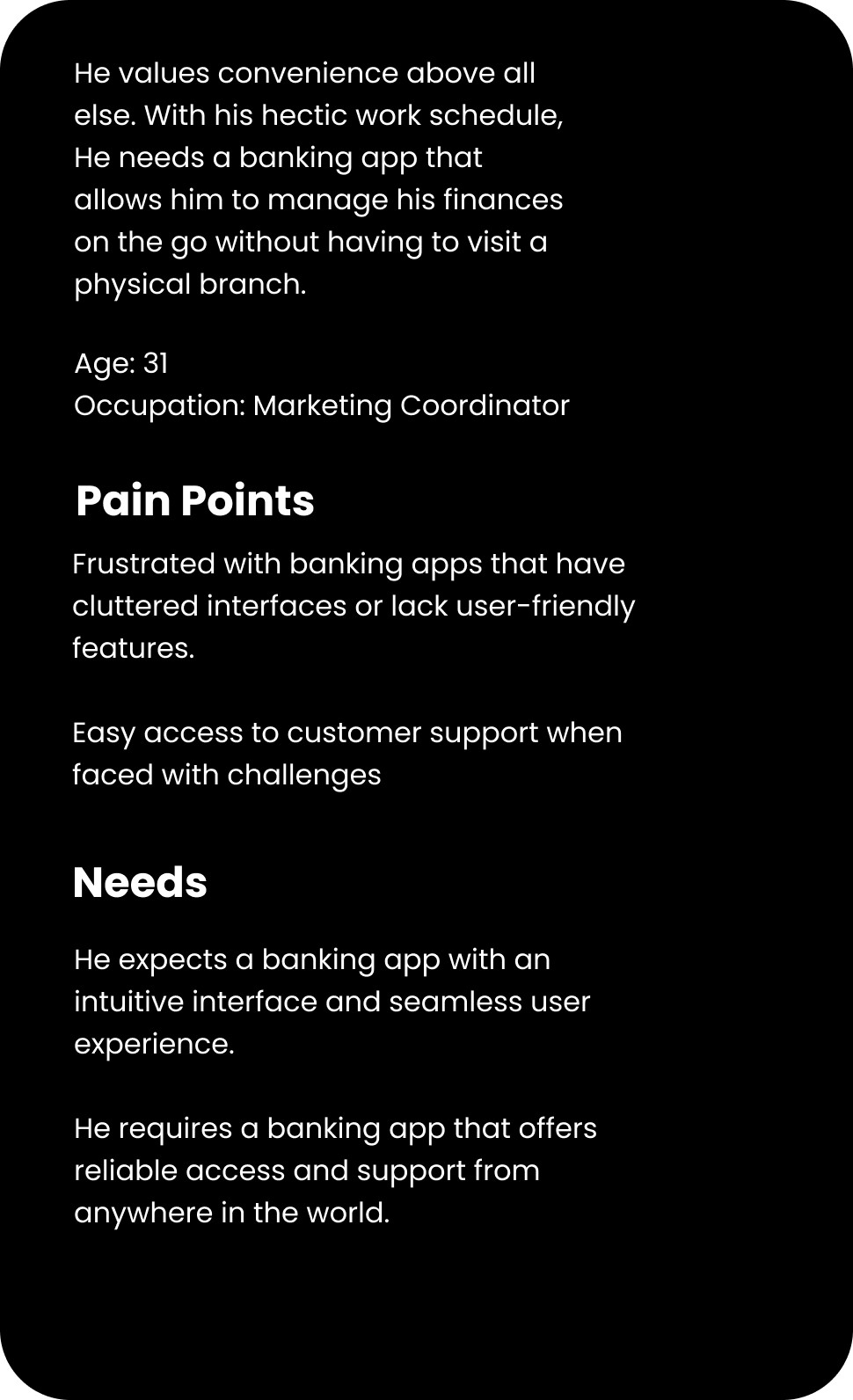

Information Architecture.

The Businessman

The Spender